Targeting vs Retargeting on Facebook

Ajit Deshpande - February 27, 2013 - 0 Comments

Last week, web retargeting firm AdRoll released an infographic comparing traditional web retargeting to retargeting on Facebook Exchange (FBX). AdRoll was one of a handful of Demand Side Platforms (DSPs) that were allowed access to FBX during its Beta testing that started in August’12. Using information from 468 out of a total of 1,300 advertisers currently on FBX, AdRoll estimates that FBX has to-date significantly underperformed traditional web targeting in CTR and in cost-per-unique. As such, AdRoll suggests it is too soon to get on the FBX retargeting bandwagon, something that another DSP, Triggit, has vocally encouraged in recent times.

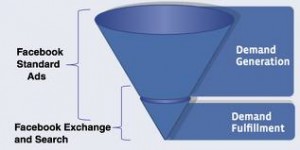

So is Facebook generally not such a good platform for advertisers? Let’s think about it in the context of ad targeting and ad retargeting:

– Ad targeting on Facebook is done through their Ads API, which allows the advertiser to target the right users based on their social profiles. Currently only some large advertisers, ad tech vendors and agencies have access to this Ads API (everyone else needs to use these approved vendors as channels). This API is *not* what AdRoll is referring to. The value here for the advertiser is clear: understand and optimize upon the nuances of advertising on Facebook, and drive increased traffic towards your site.

– For retargeting on Facebook, i.e. for remarketing to users who have already visited your site (identified through dropped cookies etc.), the platform to use is FBX. This is where AdRoll indicates Facebook currently lags traditional web retargeting.

Clearly ad targeting on FB is great at driving traffic to your website, because the Ads API provides access to user demographics and interests. But once your site visitor’s browser gets tagged with a cookie, the FB association is lost, and the cookie is now just an anonymous visitor tracker. With the FB association lost, when you retarget this anonymous site visitor using FBX, Facebook becomes just another webpage for your retargeting ad inventory. And in fact, given that the aim of retargeting is to drive towards a purchase decision and given that the typical user accessing his/her Facebook page is more interested in socialization than in a purchase, it might actually be tougher to get him/her to complete the transaction via a FBX retargeted ad. FBX in itself might thus underperform the rest of the web, which is what AdRoll’s data also indicates.

However, if we could do targeting and retargeting in sequence on FB, and if we could have the ability to track the user’s profile through this targeting + retargeting sequence (essentially using an anonymous user tracking mechanism at the advertiser’s website), then the Facebook platform could become super effective, since the user’s profile is now also an input for your retargeting algorithms. Extend this situation to non-cookie-friendly screens like smartphones and tablets, and we can realize the need for mobile audience targeting platforms such as Opus portfolio company Admobius. Clearly there are avenues for enhancements still, and therein lies the opportunity for entrepreneurs!